5 Tips for Affordable Car Insurance in Los Angeles

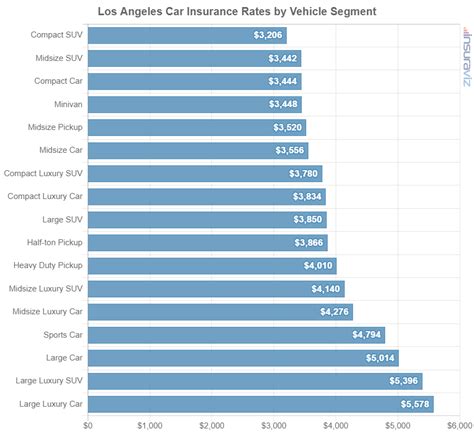

Los Angeles, known for its sprawling urban landscape and heavy traffic, is one of the most expensive cities in the U.S. for car insurance. With factors like high population density, frequent accidents, and a greater risk of vehicle theft, drivers in LA often face steep premiums. However, with strategic planning and informed decision-making, it’s possible to secure affordable car insurance without compromising on coverage. Below are five expert-backed tips to help you navigate the complexities of auto insurance in Los Angeles.

1. Compare Quotes from Multiple Insurers

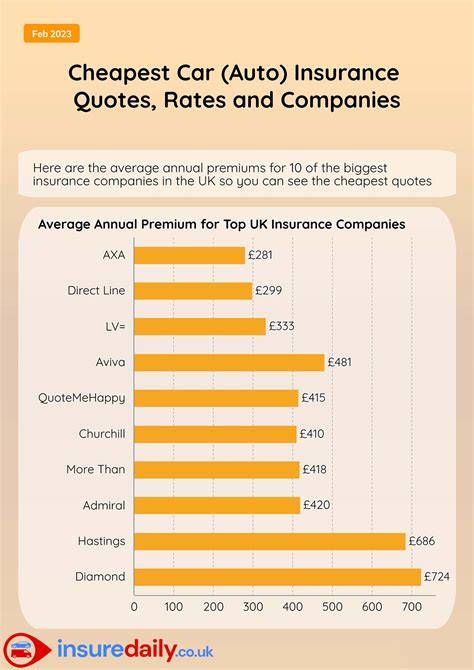

The car insurance market in Los Angeles is highly competitive, with numerous providers offering varying rates for similar coverage. Comparing quotes from multiple insurers is the most effective way to find the best deal. Use online comparison tools or work with an independent insurance agent to gather quotes from companies like GEICO, State Farm, Progressive, and local providers. Be sure to compare not only the premiums but also the coverage limits, deductibles, and customer reviews.

Key Factors to Compare

When comparing quotes, focus on:

- Liability Coverage: Ensure it meets California’s minimum requirements (15,000 for injury/death to one person, 30,000 for injury/death to multiple people, and $5,000 for property damage).

- Comprehensive and Collision Coverage: Consider these if your car is newer or financed, but weigh the cost against your vehicle’s value.

- Discounts: Look for discounts for safe driving, bundling policies, or having safety features in your car.

2. Leverage Discounts and Bundling Options

Insurance companies offer a variety of discounts that can significantly reduce your premiums. In Los Angeles, where insurance costs are high, taking advantage of these discounts is crucial. Common discounts include:

- Safe Driver Discounts: Maintain a clean driving record to qualify for lower rates.

- Multi-Policy Discounts: Bundle your car insurance with home, renters, or life insurance from the same provider.

- Vehicle Safety Discounts: Cars with anti-theft systems, airbags, and other safety features often qualify for reduced premiums.

- Low Mileage Discounts: If you drive less than the average, you may be eligible for a discount.

| Discount Type | Potential Savings |

|---|---|

| Safe Driver | 10-20% |

| Multi-Policy | 10-25% |

| Vehicle Safety | 5-15% |

| Low Mileage | 5-10% |

3. Adjust Your Coverage Based on Your Needs

While it’s essential to have adequate coverage, over-insuring can lead to unnecessary expenses. Evaluate your needs based on factors like your car’s age, value, and your financial situation. For example:

- If your car is older and paid off, consider dropping comprehensive and collision coverage to save money.

- Opt for a higher deductible to lower your premium, but ensure you can afford the deductible in case of an accident.

4. Improve Your Driving Record and Credit Score

In California, insurers use your driving record and credit score to determine your premiums. A clean driving record and good credit score can lead to significant savings. Here’s how to improve both:

Driving Record

Avoid traffic violations and accidents. Enroll in defensive driving courses to potentially remove points from your record or qualify for additional discounts.

Credit Score

Pay bills on time, reduce debt, and monitor your credit report for inaccuracies. A credit score above 700 can qualify you for lower insurance rates.

| Credit Score Range | Average Annual Premium |

|---|---|

| Excellent (800-850) | $1,800 |

| Good (740-799) | $2,000 |

| Fair (670-739) | $2,400 |

| Poor (580-669) | $3,000 |

5. Consider Usage-Based Insurance Programs

Usage-based insurance (UBI) programs, also known as pay-as-you-drive policies, can be a cost-effective option for low-mileage drivers in Los Angeles. These programs track your driving habits using a telematics device or smartphone app and adjust your premiums based on factors like:

- Mileage driven

- Speed and acceleration

- Braking habits

- Time of day you drive

Insurers like Progressive (Snapshot) and Allstate (Drivewise) offer UBI programs that can save safe drivers up to 30% on their premiums.

What is the minimum car insurance required in Los Angeles?

+California law requires a minimum of 15,000 for injury/death to one person, 30,000 for injury/death to multiple people, and $5,000 for property damage.

How can I lower my car insurance premiums in LA?

+Compare quotes, leverage discounts, adjust coverage, improve your driving record and credit score, and consider usage-based insurance programs.

Is comprehensive coverage necessary in Los Angeles?

+Comprehensive coverage is optional but recommended for newer or financed vehicles. For older cars, it may not be cost-effective.

How does my credit score affect car insurance rates?

+In California, a higher credit score can lead to lower premiums, as insurers associate good credit with lower risk.

What is usage-based insurance, and is it available in Los Angeles?

+Usage-based insurance adjusts premiums based on driving habits. Programs like Progressive’s Snapshot and Allstate’s Drivewise are available in LA and can save safe drivers up to 30%.