Instant Credit Card Processing: How It Works and Why It Matters

In today's fast-paced digital economy, instant credit card processing has become a cornerstone for businesses aiming to provide seamless and efficient payment experiences. This technology enables transactions to be authorized and completed in real-time, ensuring customers can make purchases without delays. For merchants, it translates to higher customer satisfaction, reduced cart abandonment, and increased revenue. Understanding how instant credit card processing works and its significance is crucial for any business looking to thrive in the modern marketplace.

The Mechanics of Instant Credit Card Processing

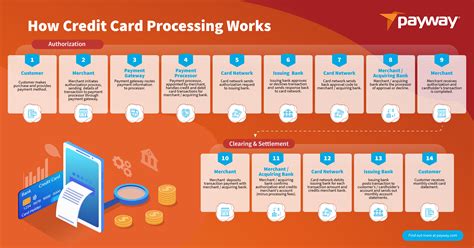

Instant credit card processing involves a series of steps that occur within seconds, ensuring a smooth transaction from start to finish. Here’s a breakdown of the process:

1. Transaction Initiation

The process begins when a customer swipes, inserts, or taps their credit card, or enters their card details online. The payment terminal or gateway securely captures the card information, including the card number, expiration date, and CVV.

2. Authorization Request

The payment terminal or gateway sends an authorization request to the cardholder’s issuing bank via the payment network (e.g., Visa, Mastercard, or American Express). This request includes transaction details such as the amount, merchant information, and card data.

3. Fraud and Security Checks

Before approving the transaction, the issuing bank performs fraud checks using algorithms and tools like Address Verification System (AVS) and Card Security Code (CSC) verification. These measures ensure the transaction is legitimate and the cardholder’s identity is verified.

4. Approval or Decline

If the transaction passes security checks and the cardholder has sufficient funds, the issuing bank sends an authorization code back to the merchant. This code confirms the transaction is approved. If the transaction fails any checks, it is declined, and the merchant is notified.

5. Transaction Completion

Once approved, the merchant’s bank (acquiring bank) receives the authorization code and finalizes the transaction. The funds are then transferred from the cardholder’s account to the merchant’s account, typically within 24-48 hours, though the authorization is instant.

| Step | Description | Timeframe |

|---|---|---|

| Transaction Initiation | Card details captured | Instant |

| Authorization Request | Sent to issuing bank | 1-2 seconds |

| Fraud and Security Checks | Transaction verified | 1-3 seconds |

| Approval or Decline | Authorization code issued | Instant |

| Transaction Completion | Funds transferred | 24-48 hours |

Why Instant Credit Card Processing Matters

The adoption of instant credit card processing is not just a technological advancement; it’s a strategic imperative for businesses. Here’s why it matters:

1. Enhanced Customer Experience

In an era where speed and convenience are paramount, instant processing eliminates waiting times, providing customers with a frictionless payment experience. This is particularly critical for e-commerce, where delays can lead to cart abandonment.

2. Increased Sales and Revenue

Faster transactions mean customers are more likely to complete their purchases. Studies show that businesses with instant processing see up to 30% higher conversion rates compared to those with slower systems. This directly translates to increased revenue.

3. Competitive Advantage

Merchants offering instant processing position themselves as forward-thinking and customer-centric. This can differentiate them from competitors and attract tech-savvy consumers who prioritize efficiency.

4. Reduced Fraud Risk

The advanced security measures embedded in instant processing systems significantly reduce the risk of fraudulent transactions. This protects both merchants and customers, fostering trust and long-term relationships.

5. Operational Efficiency

Instant processing streamlines the payment workflow, reducing manual interventions and errors. This allows businesses to allocate resources more effectively and focus on core operations.

Challenges and Considerations

While instant credit card processing offers numerous benefits, it’s not without challenges. Here are some key considerations:

1. Technological Infrastructure

Implementing instant processing requires robust technological infrastructure, including high-speed internet and compatible payment terminals or gateways. Small businesses may face initial investment hurdles.

2. Compliance and Regulations

Merchants must comply with industry standards like PCI DSS (Payment Card Industry Data Security Standard) to ensure data security. Non-compliance can result in fines and reputational damage.

3. Integration Complexity

Integrating instant processing with existing systems can be complex, particularly for businesses using legacy software. Partnering with experienced payment processors can simplify this process.

4. Cost Considerations

While the long-term benefits outweigh the costs, initial setup and transaction fees can be a concern for some businesses. However, many processors offer scalable solutions tailored to different budgets.

Future Trends in Instant Credit Card Processing

As technology continues to evolve, instant credit card processing is poised for further innovation. Here are some trends shaping its future:

1. Contactless and Mobile Payments

The rise of contactless payments and mobile wallets (e.g., Apple Pay, Google Pay) is driving demand for faster, more secure processing solutions. Instant processing will play a pivotal role in supporting these trends.

2. AI and Machine Learning

The integration of AI and machine learning will enhance fraud detection and personalize the payment experience. Predictive analytics can identify patterns and optimize transaction workflows.

3. Global Expansion

As businesses expand internationally, instant processing will need to support cross-border transactions seamlessly. This includes handling multiple currencies and complying with diverse regulatory frameworks.

4. Real-Time Payments

The shift toward real-time payments (RTP) networks will further accelerate transaction speeds, enabling funds to be transferred instantly between accounts. This will revolutionize B2B and P2P transactions.

What is instant credit card processing?

+

Instant credit card processing is a technology that enables credit card transactions to be authorized and completed in real-time, providing a seamless and efficient payment experience for customers.

How does instant processing improve customer experience?

+

Instant processing eliminates waiting times, reduces cart abandonment, and provides a frictionless payment experience, which enhances overall customer satisfaction.

What are the security measures in instant credit card processing?

+

Security measures include fraud checks, Address Verification System (AVS), Card Security Code (CSC) verification, tokenization, and encryption to protect sensitive data.

What challenges are associated with instant credit card processing?

+

Challenges include the need for robust technological infrastructure, compliance with regulations like PCI DSS, integration complexity, and initial setup costs.

How is instant processing evolving in the future?

+

Future trends include the growth of contactless and mobile payments, integration of AI and machine learning, global expansion, and the adoption of real-time payment networks.